File Your Small Business Taxes Online, Hassle-Free

1-800Accountant can prepare & e-file your business taxes online with ease. Enjoy fast, secure, and accurate tax filing for your small business.

.png?w=1080)

Big Tax Savings for Your Small Business

Support your small business's long-term growth initiatives with 1-800Accountant's suite of professional online accounting services.

Accounting for modern small businesses is complex. In addition to local and federal tax considerations, your business might have an online component that crosses state lines, creating multi-state obligations with ever-changing rules that can feel overwhelming. If handling your business's tax responsibilities has stressed your operations, it's time to consider accounting support from the online professionals at 1-800Accountant, America's leading virtual accounting firm for small businesses.

Whether your business operates online or on Main Street, we have you covered. Our accounting experts handle your business's difficult financial responsibilities end to end, freeing you to focus on your next milestone. And with year-round strategy and advice, you can always have confidence about your business tax situation.

Full-Service Tax Filing

Online accounting includes preparing and filing your business's annual income tax return and Schedule C, 1065, 1120, or 1120S.

Amended Returns

We can amend previous federal and state business tax returns for mistakes and make submissions on your behalf.

Experts and Technology

Your online business tax return is prepared using a mix of experienced accounting experts and technology, ensuring a minimal tax liability.

Powered by Real CPAs

CPAs are a business owner's best friend. They help you solve problems and answer your most challenging questions.

Accounting Services

Accounting for everything small business. From entity formation to business income tax filing and beyond, we have accounting for small business paperwork and financials covered.

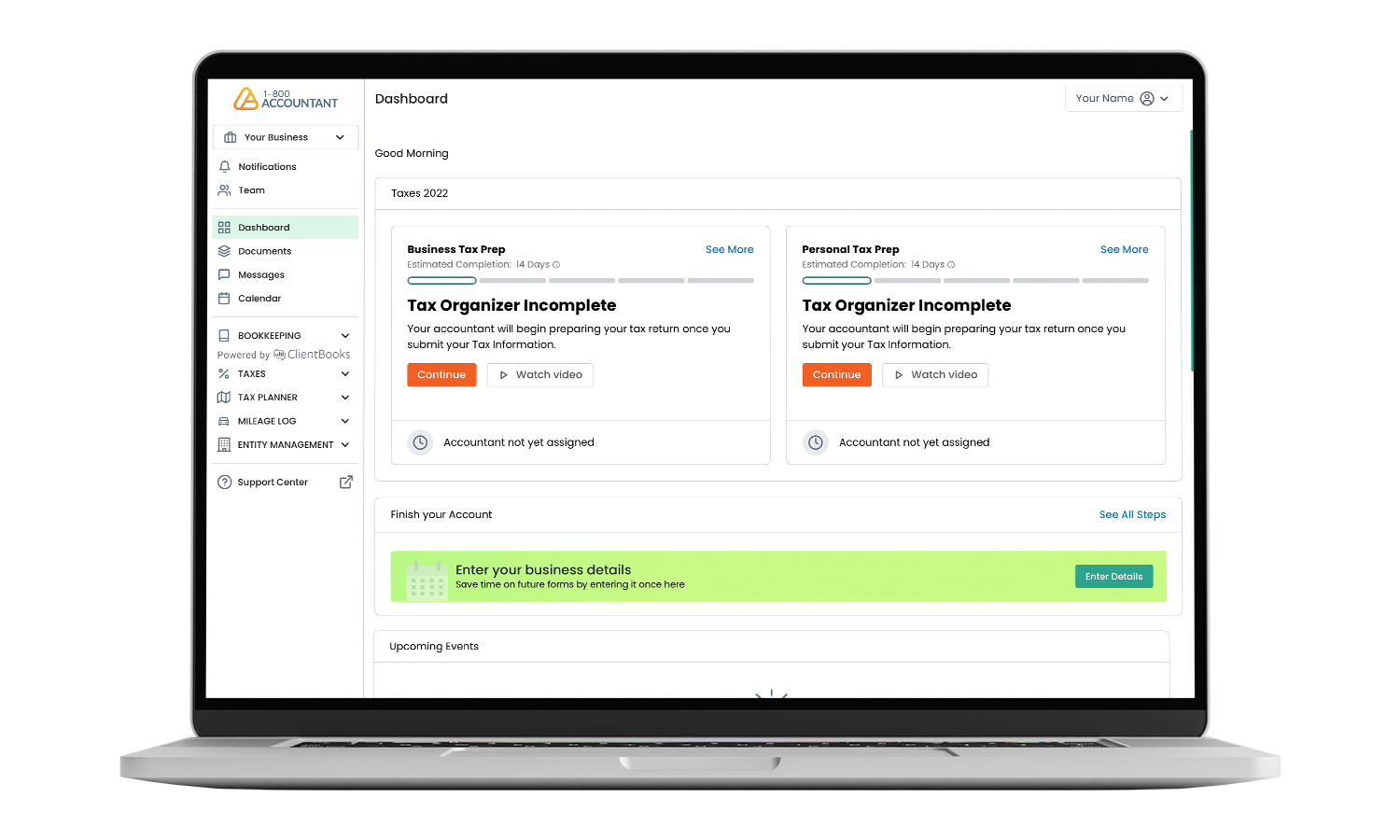

Small Business Tax Services with Unlimited Support

- Dedicated Accountant

- Unlimited Support

- Secure Online Portal

- Business Tax Preparation

- Amended Business Tax Return

Sales Tax

Looking to file small business taxes online? Business taxes are prepared and filed for you. Maximum savings guaranteed.

Franchise Tax

Avoid penalties; avoid overpaying. Annual franchise taxes are prepared and filed by our tax professionals and business accountant team.

Payroll Tax

State-specific tax advisory and accounting services. Let us handle the nuances of your payroll and sales tax.

Discussing your business taxes with 1-800Accountant is quick and easy:

- Set up a time for us to give you a call.

- Tell us what’s going on with your business.

- Get matched with an accountant who knows your industry & local regulations.

Online Business Tax FAQs

Filing your small business taxes online saves time and ensures a minimal tax burden. Online accounting provides choice beyond your local accounting generalist and connects you with the accounting experts you need to help propel your business forward.

The forms you'll use to file your taxes online can be dictated by revenue, entity type, location, and other factors impacting your business. If you struggle to identify the proper forms required to prepare and file your online taxes, we suggest talking to an accounting professional.

Like the specific tax forms your small business needs to prepare and file taxes, the financial records you should gather depend on the nature of your business. Consult an online accounting professional for insight into the records you should prepare.

Special software isn't required to prepare and file your business's taxes online. However, you may find certain features and automation helpful, particularly if you're handling your business's tax responsibilities independently.

File your business taxes online today!

Everything Accounting, All in one Place

Entity Formation

Entity selection is the key to tax savings. Partner with us to ensure you pick the best one for your situation.

Bookkeeping

Bookkeepers save you time and money. Focus on running your business and let us handle your day-to-day accounting.

Payroll

Simple integrations, automatic calculations. Running payroll and benefits is easy with experts on your team.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.